Micron's performance has soared, and next year's HBM will soon be sold out!

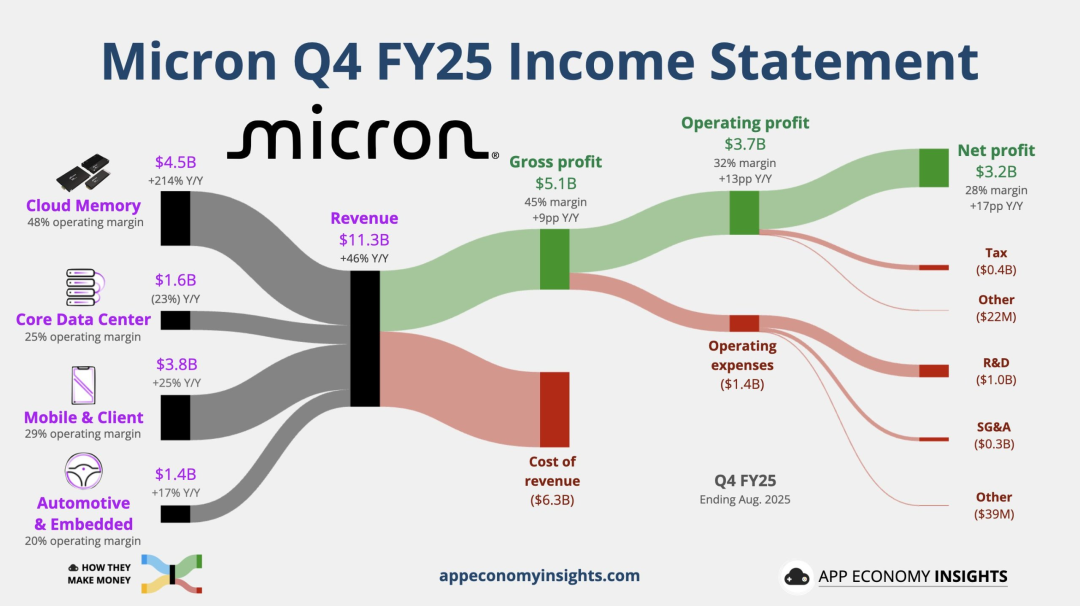

Micron Technology's fiscal fourth-quarter 2025 (three months ending August 28) earnings report, released after the market closed on September 23rd, exceeded Wall Street expectations, signaling a positive trend for AI investment and investors.Micron's fourth-quarter revenue reached $11.3 billion, a 46% year-over-year increase, topping analysts' expectations of $11.15 billion. Adjusted operating profit was $3.955 billion, up 126.6% year-over-year. Adjusted gross margin was 45.7%, up 9.2 percentage points year-over-year, exceeding analysts' expectations of 44.1% and the company's guidance of 44% to 45%, compared to 39% in the previous quarter. Micron's adjusted earnings per share were $3.03, exceeding market estimates of $2.84.

By division, Micron's largest segment, Cloud Memory, generated sales of $4.54 billion, a 34% increase quarter-over-quarter and a 214% year-over-year increase. Sales in its core data center segment increased 3% quarter-over-quarter but decreased 23% year-over-year to $1.57 billion. The Mobile and Client Division reported revenue of $3.76 billion, a 16% increase quarter-over-quarter and a 25% increase year-over-year. The Automotive and Embedded Division reported revenue of $1.43 billion, a 27% increase quarter-over-quarter and a 17% increase year-over-year.

By business type, Micron's DRAM business generated $9 billion in revenue in the fourth quarter, a 27% increase quarter-over-quarter, accounting for approximately 79% of total revenue. NAND business revenue reached $2.3 billion, a 5% increase quarter-over-quarter, accounting for approximately 20% of total revenue.

This performance not only exceeded market expectations but also exceeded the company's guidance, which had been raised in August.

Micron executives attributed this outperformance primarily to the booming AI data center market. This business (the cloud memory division, which focuses on products used in hyperscale data centers) accounted for 40% of the company's total revenue in the fourth quarter.

Meanwhile, Micron CEO Sanjay Mehrotra revealed that Micron's HBM customer base has expanded to six companies, and that Micron expects all of its HBM products for the coming year to be fully booked in the coming months.

Micron's outlook for the first quarter of fiscal year 2026 (September-November 2025) also exceeded market expectations. Micron expects first-quarter revenue to be between $12.2 billion and $12.8 billion, exceeding analysts' estimates of $11.9 billion. It also projects adjusted earnings per share to be between $3.60 and $3.90, significantly exceeding the market forecast of $3.05.

Sanjay Mehrotra stated on the earnings call, "Trillions of dollars will be invested globally in artificial intelligence over the next few years, a significant portion of which will be spent on memory. As the only US-based memory manufacturer, Micron is uniquely positioned to capitalize on this AI opportunity."

Under pressure from the Trump administration, Micron, along with several other tech giants, has increased its investment in the US. In June, Micron announced a $200 billion investment in US memory manufacturing facilities.

As one of the world's three largest memory manufacturers, Micron competes with South Korea's SK Hynix and Samsung Electronics, but the latter has lagged significantly in the AI field.

Micron's dynamic random access memory (DRAM) chips, widely used for short-term storage in everything from personal computers to AI data centers, have historically been the core of the company's revenue. Its High Bandwidth Memory (HBM) products, which stack multiple DRAM chips vertically, are key to AI infrastructure and are used in conjunction with Nvidia GPUs in AI data centers.

According to Bloomberg data, Nvidia's demand accounts for 16% of Micron's annualized revenue, and this, coupled with Samsung's lagging performance in this area, is propelling Micron to a new market position.

So far this year, Micron's stock price has risen approximately 97%, far exceeding the 18% average gain of the "Magnificent Seven" tech giants. However, market concerns are lingering over whether AI stocks are entering a bubble, and analysts are debating whether Micron's stock price can rise further.

Micron's Chief Business Officer, Sumit Sadana, stated, "We believe Micron is one of the semiconductor companies best positioned to benefit from the long-term growth driven by AI."

Deutsche Bank analysts predict that the DRAM market will surge 83% to $95 billion in 2024, driven by investments in AI infrastructure, with Micron holding a 35% market share.

Micron's earnings report shows that its DRAM business drove its performance to exceed expectations. Fourth-quarter revenue surged nearly 70% year-over-year to $8.98 billion, exceeding market expectations of $8.55 billion.

Meanwhile, Micron's NAND business revenue fell short of expectations, declining approximately 5% year-over-year to $2.25 billion, missing analysts' estimates of $2.35 billion. Micron's NAND memory chips are primarily used for long-term data storage in data centers and consumer devices such as smartphones.

However, Sumit Sadana said he expects NAND demand to rebound in fiscal 2026: "AI is the biggest driver of DRAM, but AI also has significant demand for NAND. We have begun to see increased NAND purchases from data center customers, which is improving the fundamentals of the entire NAND industry."