ADI's revenue surged 25% to $2.8 billion, driven by growth in both industrial and automotive chips.

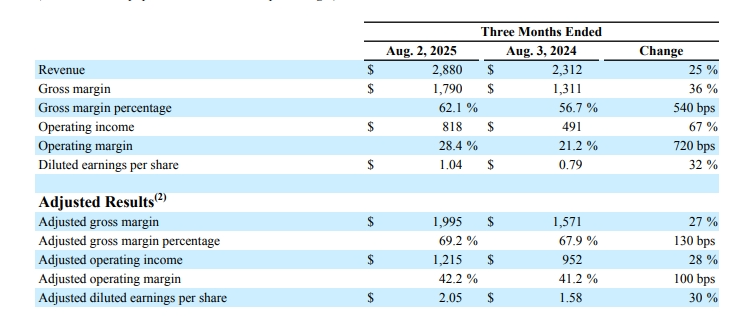

Analog IC giant Analog Devices released its latest financial report, reporting better-than-expected performance last quarter. This performance was driven not only by a surge in pre-orders ahead of the implementation of reciprocal tariffs, but also by continued strong demand in the industrial and automotive markets.According to ADI's financial report, revenue for the third quarter (ending August 2, 2025) reached $2.88 billion, a 25% increase compared to the same period last year.

Notably, all four of ADI's divisions saw double-digit revenue growth.

The largest division, Industrial, saw revenue jump 23% year-over-year to $1.29 billion, accounting for 45% of total third-quarter revenue. This was primarily due to US tariffs prompting manufacturers to rush shipments before the tariff window. The second-largest division, Automotive, saw revenue surge 22% to $850 million, accounting for 30% of total revenue. Revenue in the consumer segment increased 21% to $370 million, while revenue in the communications segment also increased to $370 million.

ADI CEO and Chairman Vincent Roche said, "Despite the impact of tariffs and international trade, ADI's third-quarter revenue exceeded the high end of our expectations. Despite ongoing market uncertainty, demand for ADI products remains strong. The company's solutions in automation, sensing, and control systems continue to see solid growth."

ADI CFO Richard Puccio added, "Healthy order momentum in the industrial market is driving continued growth in both order backlog and backlog. Our favorable third-quarter results and outlook for continued growth in the fourth quarter position us well for the end of fiscal year 2025."

Looking ahead to the fourth quarter, ADI forecasts revenue of $3 billion, plus or minus $100 million, exceeding the consensus analyst estimate of $2.82 billion.

Analysts noted that after seven quarters of revenue and profit declines, ADI returned to growth in the second quarter and demonstrated cyclical recovery momentum in the third quarter. With recovering demand in the industrial and automotive markets and the continued push for advanced semiconductor applications, the company's performance is worth watching.