Infineon's revenue reached 3.7 billion! Inventory has been significantly revised

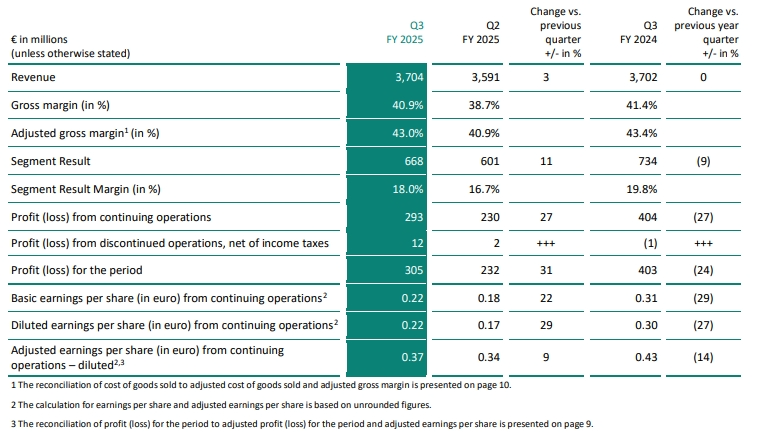

German chipmaker Infineon Technologies recently slightly raised its full-year outlook for segment profit margins. Despite the lingering impact of tariffs and a weaker dollar, Infineon's quarterly results exceeded expectations.Infineon reported revenue of €3.704 billion in the latest quarter, a 3% year-over-year increase; profit was €668 million, an 11% increase.

Infineon also reported a segment profit margin (management's preferred measure of operating profitability) of 18%, exceeding the 15.8% forecast.

Across business units, the Green Industrial Power (GIP) and Power and Sensing Systems (PSS) divisions saw significant revenue growth, while the Automotive Electronics (ATV) division saw a slight increase, while the Connected Safety Systems (CSS) division saw a slight decline.

Infineon CEO Jochen Hanebeck stated that while inventory corrections have advanced significantly, the company and its customers still face an uncertain macroeconomic and trade environment. He emphasized that Infineon is actively pursuing opportunities in strategic growth areas, including software-defined cars, which will be strengthened through the pending acquisition of Marvell's automotive Ethernet business; power solutions for AI data centers; rapidly growing energy infrastructure investments; and future humanoid robots.

Hanebeck noted that demand for semiconductors in these areas is experiencing long-term growth, and Infineon is well-positioned for these markets with its portfolio of power semiconductors, analog and sensors, and control and connectivity.

Infineon expects revenue of approximately €3.9 billion for the next quarter, with all four divisions projecting revenue growth compared to the previous quarter. For the full fiscal year 2025, Infineon anticipates revenue of approximately €14.6 billion, a slight decrease compared to the previous year. Adjusted gross margin is expected to be at least 40%, with a profit margin of around 17%-19%. Total investment will be adjusted to approximately €2.2 billion.