4.4 billion! Texas Instruments' Q2 revenue grew across the board

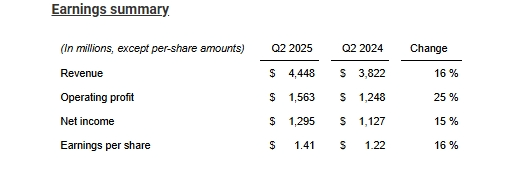

According to the latest data from Texas Instruments, revenue in the second quarter was $4.45 billion, up 16% year-on-year and 9% quarter-on-quarter. Operating profit in the second quarter was $1.56 billion, up 25% year-on-year, and analysts expected $1.47 billion.

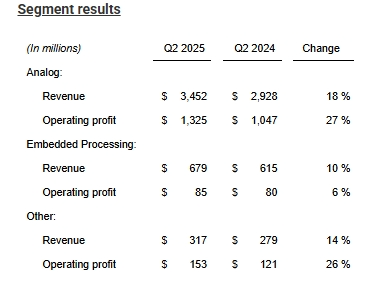

Revenues of major departments have all grown by more than 10%. In the second quarter, analog chip revenue increased by 18% year-on-year to $3.452 billion, and operating profit increased by 27% year-on-year to $1.325 billion. Embedded processing chip revenue increased by 10% year-on-year to $679 million, and operating profit increased by 6% year-on-year to $85 million.

Texas Instruments expects revenue of $4.45 billion to $4.80 billion in the third quarter, and analysts expect $4.57 billion. However, Haviv Ilan, CEO of Texas Instruments, pointed out that the third quarter of 2025 financial forecast did not take into account the impact of recent changes in US tax laws. The current tariff and trade situation is affecting and reshaping the global supply chain.

Analysts asked whether tariffs prompted customers to increase orders and increase revenue. Haviv Ilan said, "You can't rule out this possibility. When you see such a strong performance in the second quarter, you have to attribute part of it to the tariff environment."

Texas Instruments is constantly adjusting its production plans around tariffs and gross profit. In June, Texas Instruments announced that it would invest more than $60 billion to build seven wafer fabs in Texas and Utah, setting a record for mature chip production investment in the United States and expected to bring more than 60,000 jobs.

Haviv Ilan, president and CEO of Texas Instruments, said: "Texas Instruments is building reliable, low-cost, large-scale 300mm wafer production capacity to provide analog and embedded processing chips that are critical to almost all electronic systems. Leading American companies such as Apple, Ford, Medtronic, and Nvidia rely on Texas Instruments' world-class technology and manufacturing expertise. We are honored to work with them and the United States to unleash the potential of American innovation."

In the same month, Texas Instruments also announced that it would raise prices for some product lines, which was seen by the outside world as an important move to abandon price wars and maintain profit margins. It launched a price war in 2023, and its gross profit margin began to decline from 68.8% in 2022 to 56.8% in the first quarter of 2025.