Order decline! The latest performance of STMicroelectronics is 4.28 billion! Expected to fall furthe

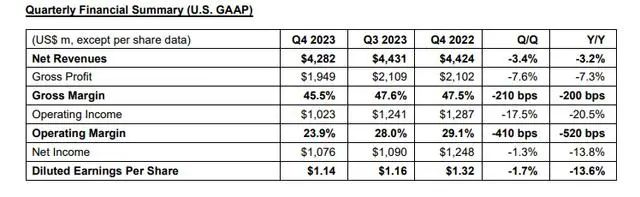

Due to slower growth in the automotive industry and further reduction in orders from the industrial sector, another semiconductor giant's sales were lower than expected.On January 26th, European chip manufacturer STMicroelectronics released its latest quarterly financial report. STMicroelectronics had a net income of $4.28 billion in the fourth quarter of 2023, a decrease of 3.2% year-on-year, lower than the average analyst expectation of $4.3 billion; Net profit in the fourth quarter decreased by 14% to $1.08 billion; Operating profit decreased by 20.5% to 1.02 billion US dollars. STMicroelectronics's net revenue for the entire year of 2023 jumped from $16.13 billion in 2022 to $17.29 billion.

Jean Marc Chery, CEO of STMicroelectronics, said, "Compared to the third quarter, our customer orders decreased in the fourth quarter. We continue to observe stable terminal demand in the automotive industry, personal electronics products have not seen significant growth, and industrial demand has further declined."

Due to weak demand for automobiles and further decline in orders from the industrial sector, the fourth quarter revenue of STMicroelectronics was slightly lower than analyst expectations. In addition, STMicroelectronics estimated the first quarter revenue to be $3.6 billion, lower than the same period last year's $4.25 billion and 11% lower than analyst expectations. By 2024, STMicroelectronics will have a net capital expenditure of approximately $2.5 billion and a target annual revenue of $15.9 billion to $16.9 billion.

Earlier, STMicroelectronics announced a restructuring of its product division, with a focus on adjusting its business direction from three product divisions to two product divisions (APMS and MDRF). The two new product groups will be: Analog, Power and Discrete, MEMS and Sensors (APMS); The restructuring of microcontrollers, digital ICs, and radio frequency products (MDRF) will take effect on February 5, 2024, and former president of the automotive and discrete product group, Marco Monti, will also leave the company.

Although orders from the automotive industry have been helping chip manufacturers offset the impact of international environmental fluctuations and sluggish demand for personal electronic products, this trend may be weakening. Texas Instruments recently announced that its revenue and profit for the previous quarter fell short of expectations, sparking concerns that the automotive chip industry may face a downturn.

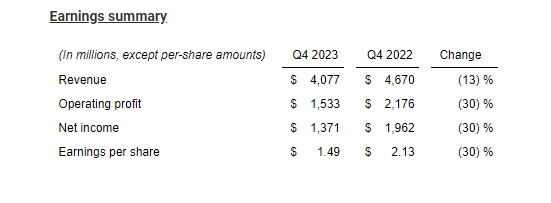

Texas Instruments' fourth quarter revenue decreased by 13% to $4.08 billion, while the average expected revenue was $4.13 billion; The fourth quarter operating profit was $1.53 billion, with analysts expecting $1.56 billion. The net profit was 1.37 billion US dollars, or 1.49 US dollars per share, compared to 1.96 billion US dollars, or 2.13 US dollars per share, in the same period last year. In 2023, sales also decreased by 13%, which is the largest decline for the company in over a decade. Expected revenue for the first quarter is $3.45-375 billion, with analysts expecting $4.09 billion.

The decline in revenue for Texas Instruments is mainly due to the continued weakness in global manufacturing activities and weakened demand from industrial customers, exacerbating the weakness in the automotive sector. The largest component of Texas Instruments' revenue comes from industrial machinery and automotive manufacturers, which also means that the weakness in the industrial and automotive sectors of Texas Instruments is further expanding.

Dave Pahl, Vice President and Head of Investor Relations at Texas Instruments, stated, "The financial report reflects the increasingly weak industrial market and a decline in automotive industry performance compared to the previous quarter, as customers are committed to reducing inventory levels."