Murata 442.7 billion, Kyocera 505.9 billion, Sun induced electricity 82.8 billion, and National Gian

Recently, Murata, Kyocera, Sun Indy Electric, and Guoju have released their latest quarterly financial reports. Although revenue has declined year-on-year, they have expressed a slow recovery in AI and memory demand for the next quarter.Murata: Revenue of 442.7 billion yen

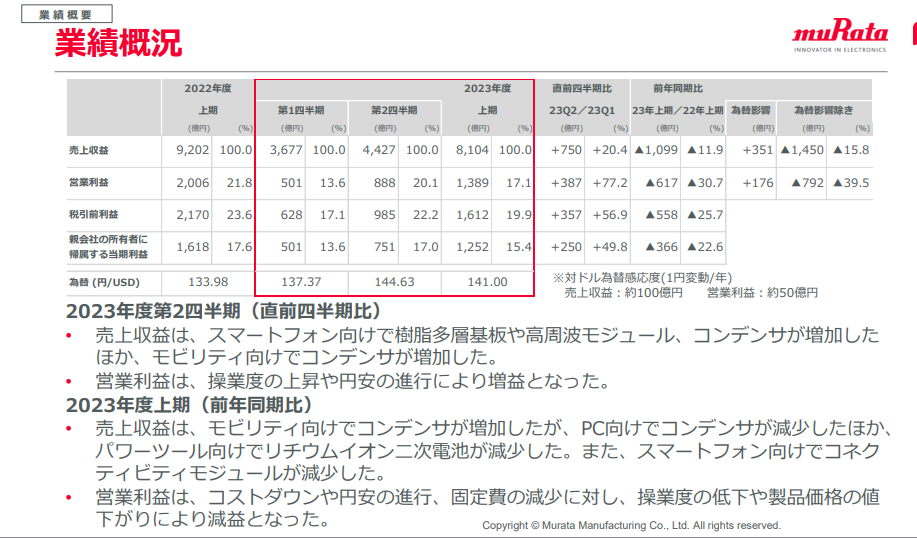

Murata announced its financial report for the previous quarter (July September 2023): consolidated revenue decreased by 8% compared to the same period last year to 442.7 billion yen, consolidated revenue decreased by 19% to 88.8 billion yen, and consolidated net profit decreased by 12% to 75.1 billion yen.

From a departmental perspective, the revenue of the Murata component department in the previous quarter increased by 1.1% compared to the same period last year to 245.4 billion yen. Among them, the revenue of capacitors increased by 1.3% to 1970 billion yen, and the revenue of inductors/EMI filters increased by 0.2% to 48.4 billion yen. The revenue of the component/module department decreased by 18.2% to 194.4 billion yen.

For the outlook for the next quarter, due to the expected increase in demand for resin multilayer substrates such as "MetroCircle" and high-frequency modules, but the expected decrease in demand for PC and home appliance capacitors, the consolidated revenue target for this year (April 2023 March 2024) has been revised down from the original estimate of 1.64 trillion yen to 1.62 trillion yen (a decrease of 4.0% annually). However, due to the depreciation of the yen, the consolidated revenue target has been revised up from the original estimate of 220 billion yen to 270 billion yen (a decrease of 9.5% annually) The merger net profit target has also been revised up from 164 billion yen to 225 billion yen (a decrease of 7.8% annually).

Murata's revenue target for the components department (including capacitors and inductors/EMI filters) this year has been revised down from the original estimate of 953.5 billion yen to 923.8 billion yen, with capacitors (mainly MLCC) revenue target being revised down from 774.4 billion yen to 748.7 billion yen, and inductors/EMI filters revenue target being revised down from 179.1 billion yen to 175.1 billion yen. Murata's revenue target for the component/module department (including high-frequency/communication modules, energy/power components, and functional components) this year has been revised up from 674.9 billion yen to 683.8 billion yen.

Kyocera: Revenue of 505.9 billion yen

Kyocera announced its financial report for the previous quarter (July September 2023): consolidated revenue decreased by 3% compared to the same period last year to 505.9 billion yen, consolidated revenue shrank by 19% to 28.3 billion yen, and consolidated net profit decreased by 25% to 19.1 billion yen.

Last quarter, the revenue of Kyocera's "core component department" decreased by 6% compared to the same period last year to 148.3 billion yen, and the revenue decreased by 35% to 16.7 billion yen; The revenue of the 'electronic parts department' shrank by 10% to 90.2 billion yen, and revenue plummeted by 60% to 5.8 billion yen.

Kyocera pointed out that due to the slower recovery of semiconductor market conditions than originally expected, the sales of related parts have declined. Therefore, the consolidated revenue target for this year (April 2023 March 2024) has been revised down from the originally estimated 2.1 trillion yen (an annual increase of 3.7%) to 2.05 trillion yen, which will increase by 1.2% annually,The consolidated profit target has been revised down from 147 billion yen (an increase of 14.4% annually) to 120 billion yen, a decrease of 6.6% annually. The consolidated net profit target has also been revised down from 145 billion yen (an increase of 13.3% annually) to 123 billion yen, a decrease of 3.9% annually.

Kyocera has lowered its revenue target for its core component department (including products such as IC substrates, ceramic substrates, and precision ceramics for semiconductor manufacturing equipment) from 620 billion yen to 567 billion yen this year; The revenue target of the Electronic Parts Department (including products such as MLCC and quartz components) has been revised down from 390 billion yen to 358 billion yen.

In addition, Kyocera has also reduced its capital expenditure target from the originally estimated 275 billion yen to 105 billion yen to 170 billion yen.

Kyocera President Hideo Tanimoto stated at the financial report press conference that "the demand for artificial intelligence (AI) and memory has shown a gradual recovery from July to September when it bottoms out. Hideo Tanimoto pointed out that the semiconductor market will truly recover in 2025, and the reduced equipment investment this year will be invested after next year.

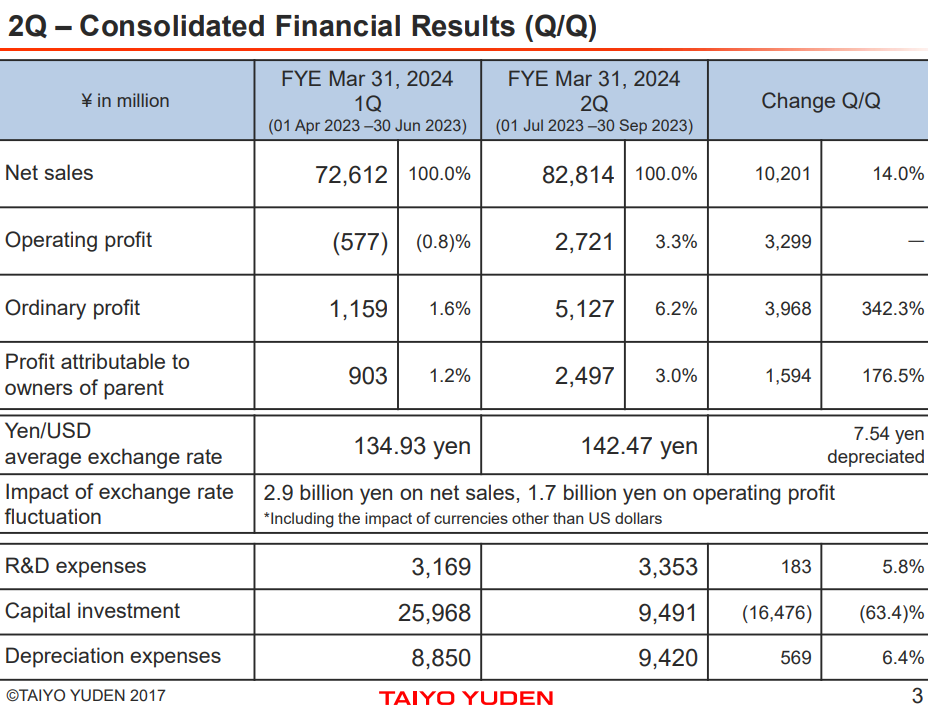

TAIYO YUDEN: revenue of 82.8 billion yen in the previous quarter

TAIYO YUDEN announced its financial report for the previous quarter (July September 2023): consolidated revenue decreased by 4.0% compared to the same period last year to 82.814 billion yen, consolidated revenue decreased by 83.5% to 2.721 billion yen, and consolidated net profit was 2.497 billion yen.

In the previous quarter, the revenue of the MLCC department of Sun Induced Power decreased by 8.0% compared to the same period last year to 51.95 billion yen, while the revenue of the inductance department increased by 3.9% to 15.748 billion yen. The revenue of the composite components department (including embedded PCBs, SAW filters, power modules, high-frequency modules and other products) increased by 0.6% to 8.326 billion yen, while the revenue of other departments (including aluminum electrolytic capacitors, energy components and other products) increased by 6.1% to 6.789 billion yen.

TAIYO YUDEN pointed out that the order amount received in the previous quarter increased by 5% compared to the same period last year to 82.2 billion yen, and showed growth for the first time in 9 quarters. Among them, the order amount of the capacitor department increased by 11% to 52.4 billion yen, and it was the first increase in 8 quarters.

TAIYO YUDEN pointed out that due to the sustained and stable demand for vehicles and an increase in demand for communication machines such as smartphones, it is estimated that the revenue of the capacitor department in this quarter (October December) will grow by 4-8% compared to the previous quarter, the inductance department will decrease by 2-6%, and the composite component department will increase by 1-5%.

Yageo: Last quarter revenue of NT $27.3 billion

Yageo's consolidated revenue in September was NT $9.461 billion, a monthly increase of 5%; The cumulative consolidated revenue for the third quarter was NT $27.359 billion, a 2.1% increase, slightly better than the financial forecast, and remained unchanged from the second quarter. Yageo's consolidated revenue in the first three quarters was 8.0246 billion yuan, a decrease of 13% compared to the same period last year.

Yageo stated that the consolidated revenue in September increased compared to the previous month, mainly due to the early buying momentum before the National Day holiday. However, the inventory and terminal demand in the supply chain are still continuously adjusting, and it is estimated that the gross profit margin and operating net profit margin in the third quarter will remain unchanged or slightly increase.

Yageo CEO Wang Danru explained that the standard product production capacity utilization rate of 25% in the fourth quarter is estimated to be equivalent to that in the third quarter, about 40% to 50%; The estimated utilization rate of special product production capacity, which accounts for 75%, is about 70%, which is also equivalent to the third quarter. The estimated overall crop growth rate is about 60% to 70%, which can be continued until the first quarter of next year.

From an application perspective, Wang Danru pointed out that the demand for vehicles, including electric vehicles, continues to be strong, industrial control, 5G and other applications are stable, and demand for consumer electronics terminals is still weak. However, the expected inventory level adjustment is nearing its end. He expects that from the fourth quarter to the first quarter of next year, it will be the bottom of the passive component industry cycle, including mobile phones and laptops that can reach a bottom, and demand will gradually stabilize.

☆ END ☆