Global official announcement! Infineon is about to formally acquire Cypress!

Yesterday (April 7), the merger of Cypress Semiconductor Corporation (CY.US) and Infineon had obtained the antitrust license from the State Administration of Market Supervision of China. So far, Infineon's acquisition of Cypress Semiconductor has obtained all necessary regulatory approvals, and the merger is expected to be completed around April 16.

Infineon announced that it will acquire Cypress for $ 23.85 per share in cash, with a total value of 9 billion euros. Previously, Infineon had expected the transaction to be formally completed by the end of 2019 or early 2020.

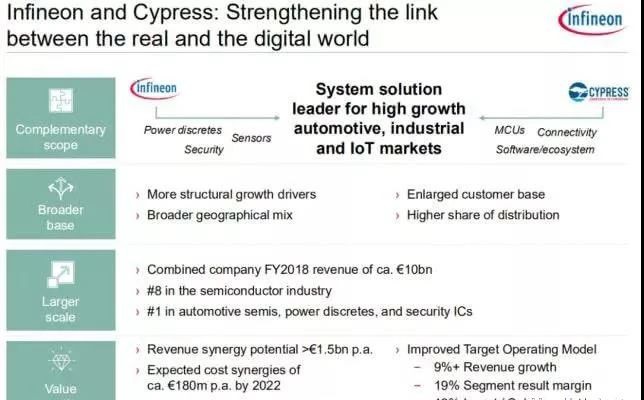

The transaction price of 9 billion euros makes this transaction the largest merger in the semiconductor industry in 2019. At the time, Infineon believed that by 2022, the expected economies of scale would create a cost synergy of 180 million euros per year; in addition, the complementary product portfolio of the two parties would provide more chip solutions, and the potential revenue synergy effect in the long run.

It is expected to exceed 1.5 billion euros per year. However, just a few days ago, US media also reported that CFIUS may prevent the acquisition because some officials believe it will pose a risk to "national security." And this is indeed a matter of concern for the two semiconductor companies. Currently, after CFIUS lights a "green light," Chinese regulators approve the acquisition. In early March, the German semiconductor company Infineon and the US semiconductor company Cypress (Cypress) issued an announcement that the US Foreign Investment Commission (CFIUS) has completed the acquisition of Infineon's Cypress transaction Review and believe that the transaction has no "national security" issues. Europe's top three: ST and NXP have entered the top ten, and once Cypress is acquired, it is expected to become the eighth largest chip maker in the world.

Infineon took a fancy to Cypress's advantages in the automotive, Internet of Things and other fields. Infineon's security expertise coupled with Cypress's connection technology will allow the company to accelerate its entry into new IoT applications. In automotive semiconductors, the expanded combination of microcontrollers and NOR flash memory will bring great potential, especially considering their increasing importance in advanced driver assistance systems and new electronic architectures in vehicles.

It can be seen that Infineon and Cypress are highly complementary. Through the layout of Cypress in computing, software ecosystem and connection, Infineon can better connect the real world to the digital world.

In the future, Infineon will focus on Cypress's MCU and connection business, and can have more sales opportunities for power, sensing and safety-related products, combining the four core businesses (sensing, computing, execution, connection) and software , Can provide more solutions from product to system opportunities. In the future intelligent era, there will be hundreds of billions of devices interconnected, of which the demand for intelligence and connectivity is increasing day by day. Such as smart home appliances, cordless power tools, motor control, smart home, etc. all need to be interconnected.

Taking air conditioning as an example, the complementarity of the two parties is reflected in the fields of MCU, motor control, HMI, connection, etc. The two parties can provide the most complete solution in the future. In addition, in the fields of intelligent lighting, robots, cordless power tools, etc., both sides have obvious complementary roles.

In addition to the Intelligent Internet of Things, in the automotive field, the complementarity of the two sides is still obvious. Although there are MCU product lines, Cypress is concerned about the body and the Infotainment system. At the same time, in the field of NOR Flash and Internet (WiFi, BT, USB-C), Cypress can continue to supplement Infineon products Line blank.

Infineon particularly emphasized the role of NOR in the future Infotainment, dashboard and ADAS system, which is also one of the strongest technologies in Cypress's automotive field. In addition to NOR, Cypress has a strong market base in automotive SRAM, F-RAM and other fields. As mentioned earlier, in addition to having some coincident products on the embedded system MCU, both parties can achieve strong complementarity in other areas.

From a regional perspective, Infineon can significantly expand its share in the Japanese market, which is undoubtedly important for automotive electronics. In terms of channels, more Cypress distribution customers can also allow Infineon to cover a wider customer base. In terms of market segmentation, both Infineon and Cypress are the top two markets in the automotive and industrial markets. After the merger, they remain the company's most important development direction. In the future, Infineon's goal is to achieve an average market growth rate of four times, including power, radio frequency, embedded and interconnected four blocks, the memory will remain stable.

Infineon is headquartered in Munich, Germany. It was formerly the semiconductor division of the Siemens Group. It was independent in 1999 and went public in 2000. It is one of the world's leading semiconductor manufacturers. According to statistics from IC Insights, a third-party semiconductor research organization, Infineon ranks 13th in the ranking of semiconductor companies in 2019. Once it gets Cypress, Infineon will enter the industry's top ten, become the eighth largest chip manufacturer in the world, and will become the leading chip supplier in the automotive electronics market based on power semiconductors and safety controllers. Judging from the 2019 financial report, after the merger of Infineon and Cypress, the new Infineon market share in automotive electronics is expected to reach 13%, surpassing competitor NXP (NXPI.US) to become the largest automotive chip in one fell swoop. supplier.