ST CEO: Prices may increase in the second half of the year, and the chip shortage will continue unti

According to a Reuters report, STMicroelectronics' chief executive said on Thursday that global chip shortages hinder Apple and Volkswagen and other giant companies' forecasts for future production, and this shortage will continue until the first half of 2023.

"The situation will gradually improve in 2022, but we will not return to normal conditions before the first half of 2023..." the company EO Jean-Marc Chery said in an interview.

Chery, who has been leading the French-Italian chip maker since 2018, said that the chip shortage stems from a surge in demand from all walks of life and is stimulating prices. He said that the average price of STMicroelectronics chips in 2021 was up 5% from a year ago, and added that the group expects prices to rise further in the second half of 2021 and 2022.

"This is different from the past, when everyone was waiting for Microsoft to release a new operating system to drive demand for more computers," Chery said. "But what we have now is a global industry shift...a lot of component orders."

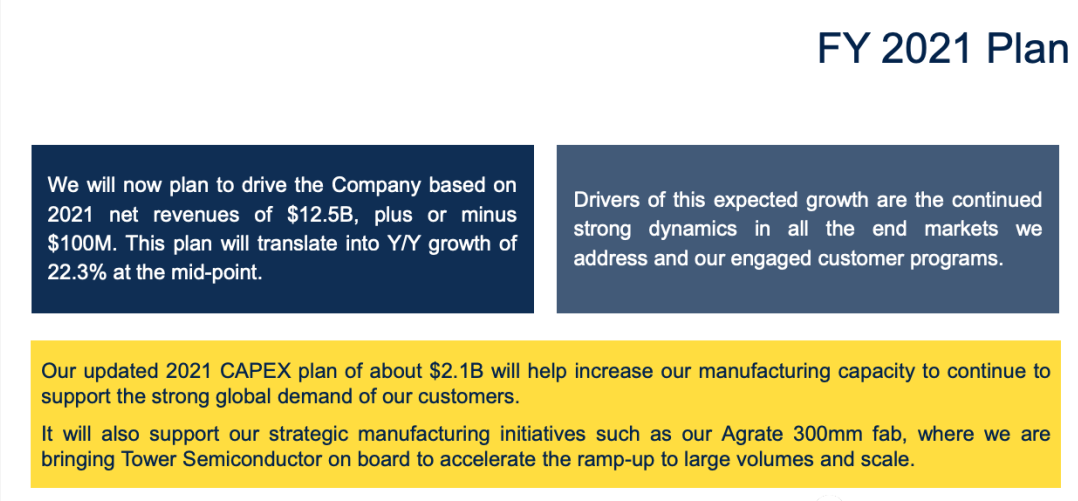

Chery said the Geneva-based group will only meet 70% of total customer needs this year. He added that with the company's investment in production capacity, this proportion will rise to 85-90% next year.

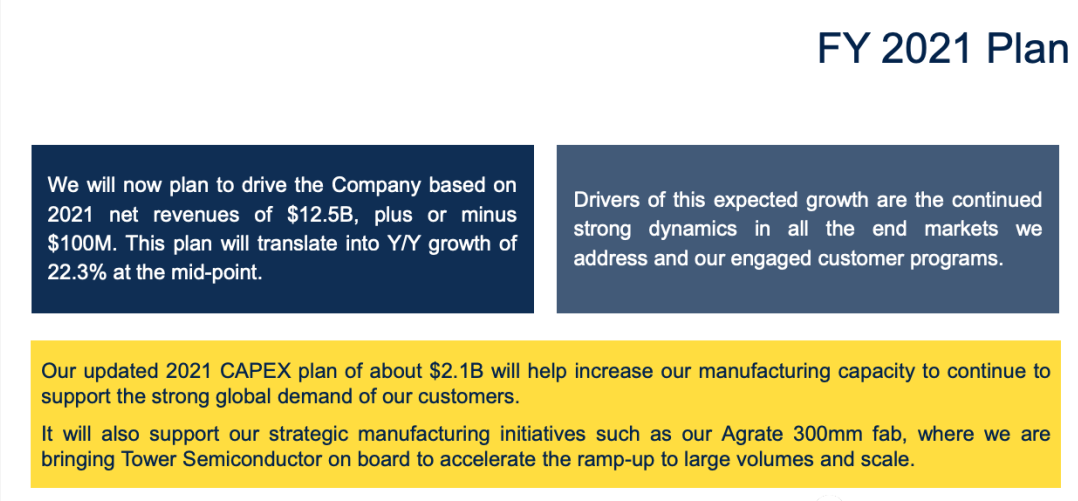

Earlier on Thursday, STMicroelectronics raised its full-year sales and investment prospects due to a surge in demand from auto and mobile phone manufacturers boosting second-quarter profits.

STMicroelectronics' Q2 net profit increased by 357.2% year-on-year

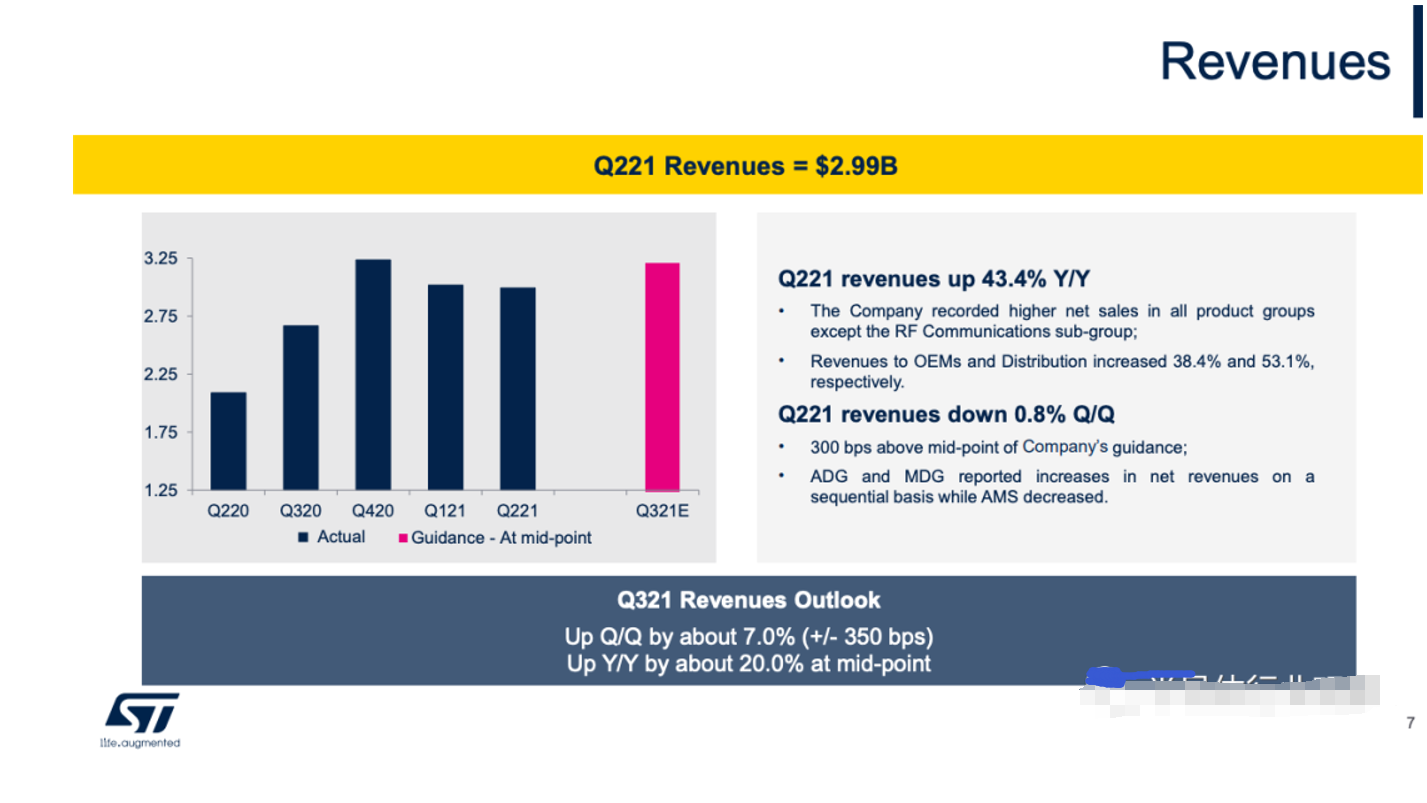

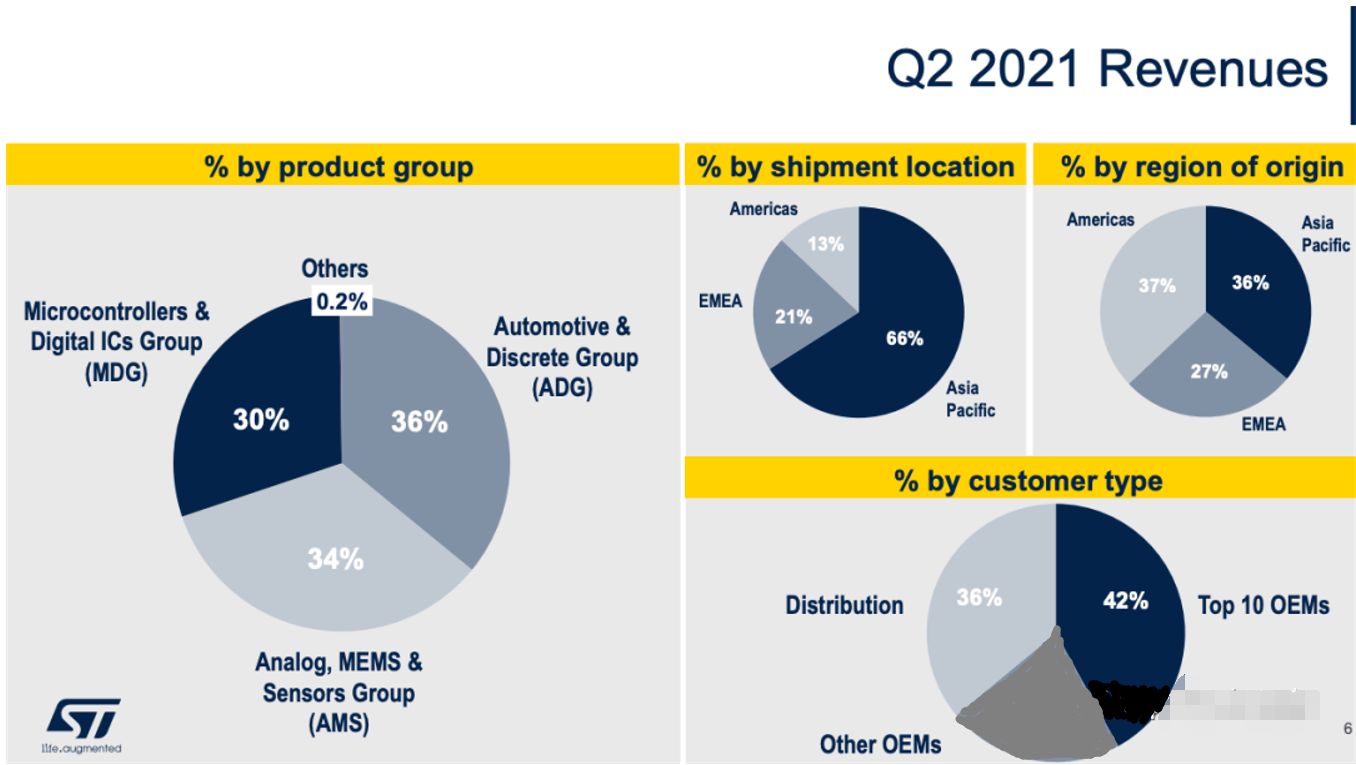

A few days ago, STMicroelectronics announced its financial results for the second quarter ending July 3, 2021. Data show that Q2 net revenue was US$2.992 billion, compared with US$2.087 billion in the same period last year, a year-on-year increase of 43.4% and a month-on-month decrease of 0.8%.

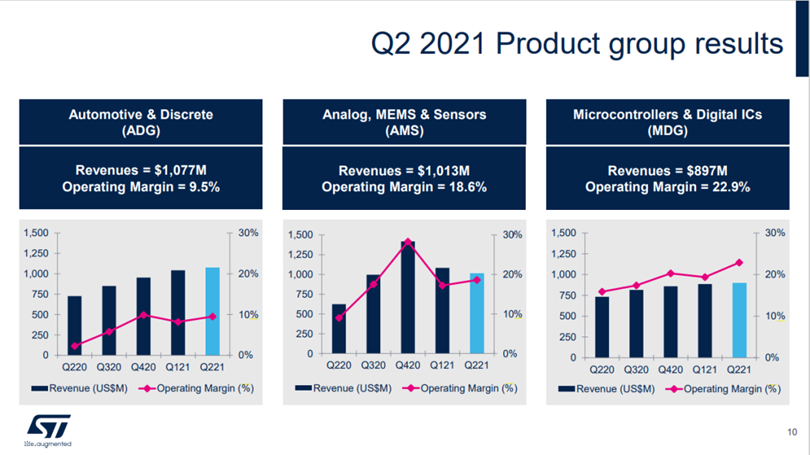

Among them, according to product group division, ADG department revenue was 1.077 billion U.S. dollars, compared with 727 million U.S. dollars in the same period last year, an increase of 48.2% year-on-year and an increase of 3.3% month-on-month. The revenue of the AMS division was US$1.013 billion, compared with US$624 million in the same period last year, an increase of 62.3% year-on-year and a decrease of 6.5% month-on-month. MDG's revenue was US$897 million, compared with US$733 million in the same period last year, a year-on-year increase of 22.3% and a month-on-month increase of 1.2%. Revenue from other divisions was 5 million U.S. dollars, compared with 3 million U.S. dollars in the same period last year.

Gross profit was US$1.212 billion, compared with US$730 million in the same period last year, an increase of 66.1% year-on-year and a month-on-month increase of 3.1%. The gross profit margin was 40.5%, compared with 35% in the same period last year.

Net profit was US$412 million, compared with US$90 million in the same period last year, an increase of 357.2% year-on-year and 13.1% month-on-month.

Diluted earnings per share were US$0.44, compared to US$0.1 in the same period last year, a year-on-year increase of 340% and a month-on-month increase of 12.8%.

Looking ahead, the midpoint of the company's Q3 performance guidance for 2021 is that net income is expected to be US$3.2 billion, a month-on-month increase of 7.0%, and fluctuations of 3.5%. Gross profit margin is about 41.0%, fluctuating up and down 2%. The Q3 performance guidance is based on the assumption that the effective currency exchange rate for Q3 in 2021 is approximately 1.19 US dollars to 1 euro, and includes the impact of existing hedging contracts. The company's third quarter will end on October 2, 2021.

-End-