ADI Official Announcement!

Just now, ADI officially announced that it has formally merged with Maxim Integrated.ADI claims to strengthen its leadership in analog semiconductors, and another analog giant is born worldwide! Revenue will exceed US$8.2 billion!

Previously, it was rumored that ADI planned to acquire Meixin at a price of about $20 billion. The combined company’s valuation will be close to $70 billion. Now this rumor is true!

The status of global analog overlord TI is in jeopardy, and its share will surely be further eroded.

The official announcement reads as follows: Analog Devices, Inc. (Nasdaq: ADI) and Maxim Integrated Products, Inc. (Nasdaq: MXIM) announced today that the two parties have reached a definitive agreement that ADI will acquire Maxim in an all-stock transaction, the merged enterprise It is worth more than 68 billion US dollars. The transaction was unanimously approved by the boards of directors of the two companies to strengthen ADI’s position as a leader in analog semiconductors and expand its breadth and scale in multiple attractive end markets.

According to the terms of the agreement, Maxim shareholders will receive 0.630 shares of ADI common stock for each share of Maxim common stock held at the end of the transaction. After the transaction is completed, ADI's existing shareholders will own approximately 69% of the combined company's shares, while Maxim shareholders will own approximately 31% of the shares. As far as US federal income tax is concerned, the transaction is designed to qualify for tax-free restructuring.

"This exciting news announced with Maxim today is the next step in ADI's vision of connecting the physical and digital worlds. ADI and Maxim share a common passion for solving the most complex problems of customers, as our technology and talent portfolio With the increase of breadth and depth, we will be able to develop more complete and cutting-edge solutions," said Vincent Roche, President and CEO of ADI. "Maxim is a respected signal processing and power management franchise company with a mature technology portfolio and an impressive history of authorized design innovations. Working together, we are fully capable of achieving the next wave of semiconductor growth while serving everyone Design a healthier, safer and more sustainable future."

"For more than thirty years, we have based Maxim on a simple premise-continuous innovation and development of high-performance semiconductor products, giving customers the ability to invent. I am excited about the next chapter, because we will continue to promote the possibility with ADI The boundaries of both companies. Both companies have strong engineering and technical knowledge and a culture of innovation. Through cooperation, we will build a stronger leader and bring superior benefits to our customers, employees and shareholders." President and President of Maxim Integrated CEO Tunç Doluca said.

After the transaction is completed, two Maxim directors will join the ADI board of directors, including Maxim President and CEO Tunç Doluca.

After ADI acquired Maxim, it was one step away from TI.

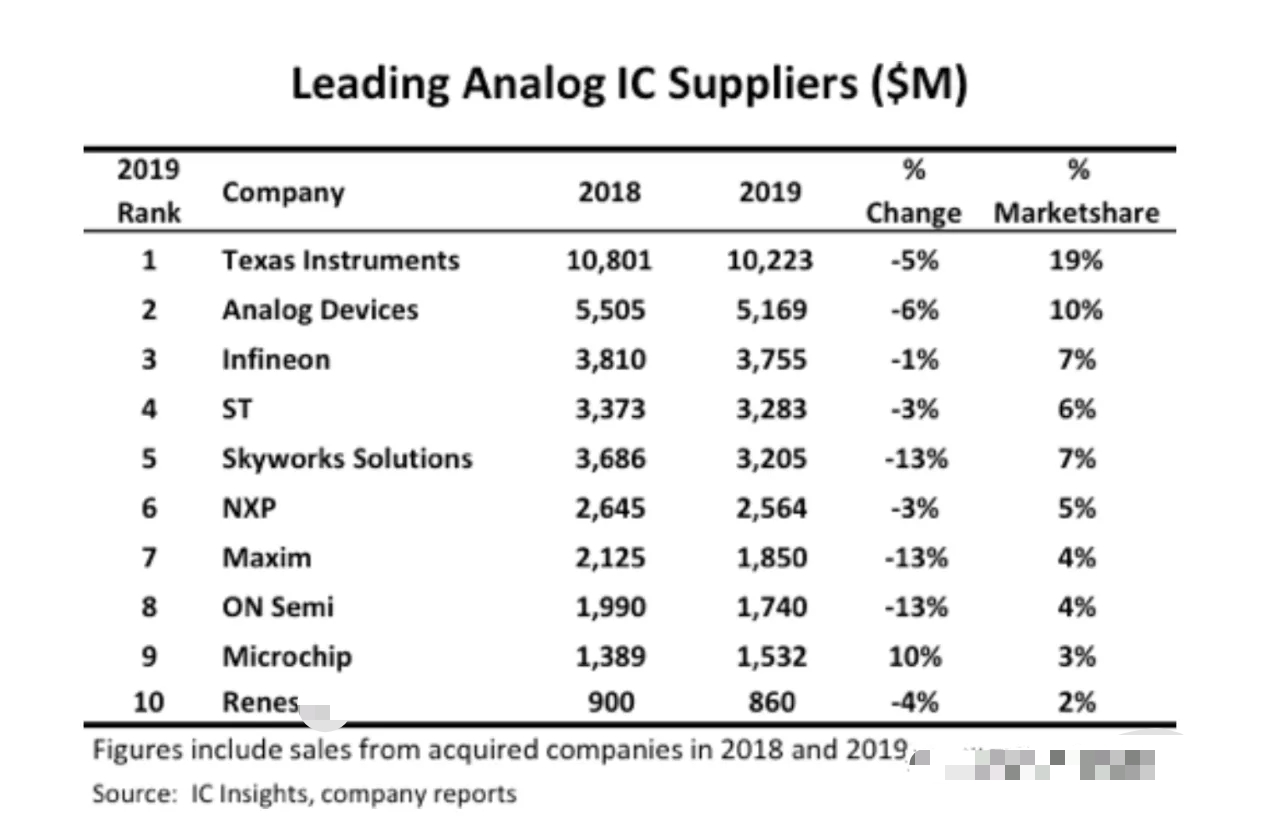

According to the ranking of global analog IC manufacturers released by IC Insights, Texas Instruments (TI) in 2019, with an analog chip sales of 10.2 billion and a market share of 19%, is firmly seated as the leading supplier of analog chips in 2019. The share of ADI and Maxim is only 14%. If the two can produce an effect of 1+1>2, then it will almost shake the position of Texas Instruments. This distance is another Maxim.