Has MLCC increased its price

Japanese typhoon, many factories have stopped working, has MLCC increased its price?

Recently, the strongest typhoon hit Japan in 60 years. Typhoon Haji Bay caused heavy disasters in Japan. As of October 20, the death toll rose to 79. In addition, 11 people were still missing and 396 were injured. The heavy rainfall brought by the typhoon Haji Bay also caused many rivers in East Japan to break down, which is one of the causes of the severe disaster. According to statistics, there are 130 rivers in 71 counties in 7 counties, with 528,800. The house is flooded.

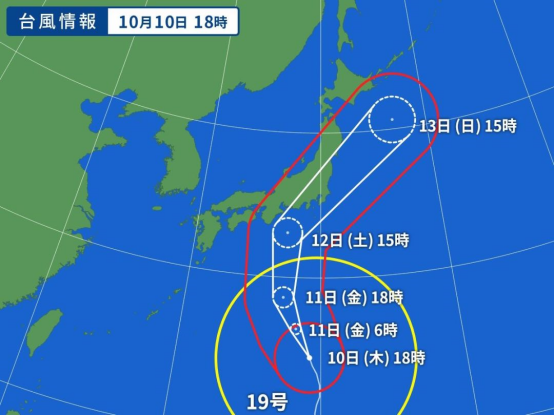

It can be seen from the typhoon road map that the typhoon hits from the southeast of Japan, and then the wind direction will gradually turn to the north, and maintain a strong momentum to approach the East Japan and West Japan regions.

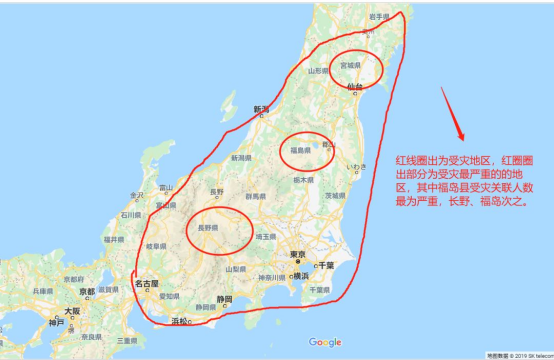

According to comprehensive Japanese media reports, affected by the typhoon, Fukushima, Nagano, Miyagi, Chiba, Ibaraki and other places were seriously affected. Among them, Fukushima and Nagano’s electronics industries were heavy, and many Japanese companies were also caused by disasters. The plant was flooded and shut down, including Alps Alpine, Taiyo Yuden, Matsushita, Hirose Electric and many other companies.

Natural disasters are likely to cause market turmoil

Whenever a flood, fire, earthquake or other disaster occurs, it is easy to cause market volatility. At this time, there will always be some bad manufacturers or dealers taking the opportunity to cause the market to fluctuate, which is often unsatisfactory. This is more obvious in the storage market. :

In March 2011, Japan’s magnitude 9 earthquake caused memory chip prices to rise by nearly 10% and flash memory prices to reach 20%.

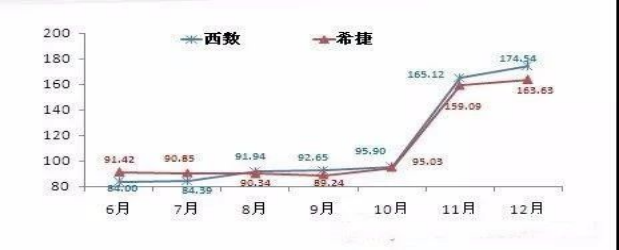

Impact of floods in Thailand on the industry - hard disk price trends in 2011

In July 2011, the floods in Thailand flooded the Western Digital hard disk factory, causing a sharp drop in production capacity. At the time, in the Huaqiangbei market, the price of the most representative 500G hard disk increased by 100%, and the 260 yuan 500G hard disk directly rose to 500 yuan.

On May 9, 2013, Hynix's Wuxi Jianding plant in Jiangsu Province suffered a fire, as the memory chip capacity of the Wuxi plant accounted for 15% of the global total capacity. After the fire broke out, the global memory chip production capacity dropped sharply by 9%. Natural disasters + man-made disasters pushed memory prices up more than 40%.

As can be seen from the above incidents, the price increase generally comes from two factors: capacity is affected and man-made. The analysis of whether the typhoon will cause price increases can also be analyzed through these two dimensions.

Judging from the information currently available, companies in the Fukushima Prefecture region have the most serious losses, mostly in component processing plants, involving automotive electronics, communications, semiconductor materials and other fields. Fukushima Prefecture is the county with the largest number of workshops and the highest product listing in the northeastern part of Japan. In particular, the number of workshops in the processing and assembly industry ranks first in Japan, and the related products of the electronics industry account for more than 30% of the total industrial production of the county. Sending machinery (automobiles, aircraft) components, semiconductors (precision electronic processing, etc.), medical equipment, etc. are the focus of the county's development.

Overview of some typhoon affected enterprises:

Other companies implicated in the typhoon:

Japanese car manufacturer SUBARU: Due to the flood of some parts suppliers, the company's auto parts supply is affected, so the company decided to be the only 4-wheel factory in China, Gunma Manufacturing, since October 16, 3, Japan time The work was suspended from 15 minutes and production is expected to resume on October 25, with a downtime of 9 days (including October 16).

The Toyota automatic weaving machine that produces forklifts was unable to deploy parts from the disaster-stricken areas due to the impact of Typhoon No. 19. Since the 16th, the plant in Takahashi City, Aichi Prefecture has been shut down.

At present, as a whole, some enterprises have been affected less and have resumed production. Als Alpine, Hirose Motor, Hitachi, and Matsushita have suffered more serious damage. SUBARU and Toyota automatic weaving machines have temporarily stopped production due to supply chain parts.

The solar power production capacity has been damaged, has the MLCC increased its price?

In the earthquake, the suspension and work of solar induced electricity has the highest impact and attention, mainly related to the field in which solar traps are located. As we all know, Taiyo Yuden is a manufacturer of electronic passive components. The main products are MLCC (Multi-layer Ceramic Capacitors) and ceramic resistors. In late September, the MLCC market showed signs of bottoming out. Crazy "MLCC smashing goods" started.

In the field of capacitors, Japanese manufacturers account for more than half of the global MLCC market share, reaching 53%, Korean manufacturers account for about 19%, Taiwan manufacturers account for about 20%, and Chinese manufacturers account for only 7%. At present, the world's top five MLCC plants Murata, Samsung Electric, Taiyo Yuden, Guoju, Huaxin Branch cover nearly 80% of the global market share. From the perspective of the ratio, it is possible to see the importance of Taiyo Yuden in the entire MLCC market. The disaster-induced solar lure Fukushima plant is one of the 12 Japanese production bases for Taiyo Yuden.

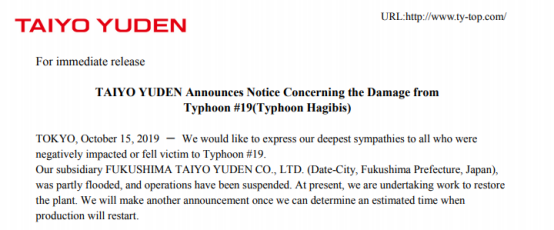

Regarding whether the typhoon caused fluctuations in the MLCC market, the solar lure did not respond directly. However, Taiyo Yuden No. 19 issued a notice on October 15th about the damage caused by Typhoon No. 19 (Hagibe): Due to the flood caused by Typhoon No. 19, the solar lure plant has been suspended, now we are Grasp the repair equipment and we will issue another notice once we have determined the exact time of capacity recovery.

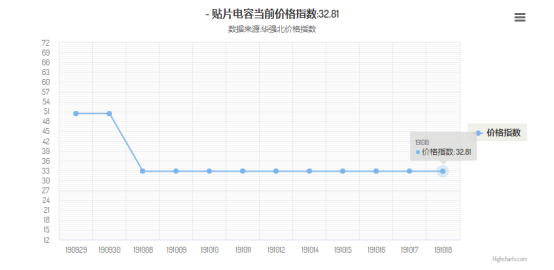

After MLCC experienced the “out of stock price increase” in the previous two years, the price of 2019 fell by 25%-30% in the first quarter and 15%-20% in the second quarter. From the end of last year, the original factory and channel operators began to go. in stock. Some time ago, after the e-mail of Huaxinke’s stop order was issued, Guoju and Samsung Motors also released news of tight production capacity. MLCC began to reverse the market, and the market’s “price increase and speculation” broke out again. The trapping of the Fukushima Plant was affected by the typhoon, which made the supply of capacitors tighter.

However, it is worth noting that this wave of price surges before the typhoon was mainly initiated by the original factory. Some agents said in the interview: "This wave of MLCC price increase is because the original factory actively raises prices, and agents/traders are difficult. The price is raised because the price of the original factory shipment is already high, and the space for speculation left to agents or traders is not large. Two years ago, the price increase of MLCC was indeed related to the tight production capacity of the industry. The agents/traders are profitable, and it’s hard to get a share of this price increase agent/trader."

In addition, from the demand side, the current kinetic energy demand of 5G terminals and electric vehicles is relatively weak, and the production capacity is not as good as expected. Agents and traders are more conservative in this MLCC market.

In summary, although the typhoon Hajibei has caused tight supply, the market is not particularly large, mainly due to the impact of the original factory, and some people in the industry pointed out that the global MLCC capacity will run at most 50%-60%. In addition, the original factory has already started the expansion plan, and the subsequent production capacity will gradually be released. Under the influence of the rushing price of roasted seeds and nuts, many agents and traders have become calm after seeing the truth of the "wolf coming" story, and are still in a wait-and-see state.

China's largest passive component distributor, Japan Electric Power, agrees that the rush to emerge and MLCC inventory has become more reasonable. For the current MLCC market situation, the Sino-US trade war is still the biggest variable. The company believes that the downstream end will take effect on December 15th. Before rushing to pull goods, plus MLCC stocks have been effectively digested, the inventory water level has become more reasonable, so it is obvious that rush orders have emerged in recent days, but the terminal demand after the tariffs take effect remains to be seen.

For the urgent demand of MLCC, the original factory is more optimistic. Japan’s Nikkei News reported that Mr. Murata said in an exclusive interview that global electronic component demand is bottoming out, and the demand for electronic components including MLCC is expected to At the beginning of 2020, inventory adjustments may end in a short period of time. In addition, Murata has high hopes for the demand for smartphones and 5G basebands next year.

According to an industry research report, the demand for passive components in the 5G era will be 20% higher than that of 4G in 2020. The sub-6GHz 5G mobile phone will be about 10% more, and the mmWave millimeter wave 5G mobile phone will increase the usage by 20-30%. Last year's iPhone X mobile phone MLCC used about 1,100, the average mobile phone usage of MLCC in the 5G era will exceed 1,200. The number of mid-range mobile phone MLCCs must also be more than 500 (4G usage is 300~500).

In addition to the demand brought by 5G, the industry believes that with the increase in the penetration rate of new energy vehicles and electric vehicles, automotive MLCC will also bring strong demand growth. In terms of vehicle electronics, the traditional fuel vehicles are intelligent and electrified. The power control engine, steering engine, idle stop, regenerative braking, engine drive and other electronic control circuits all use the vehicle standard MLCC. High, the more control modules required, the larger the number of MLCCs required. At present, the average MLCC consumption per vehicle is about 4,000. The MLCC demand for each new energy vehicle is about 10,000, and the number of MLCCs for pure electric vehicles is even more. many.

According to Murata's forecast of various types of automobile production in the world, by 2024, the annual compound growth rate of global automotive MLCC demand is 8%.

In the face of natural disasters, human beings are very small. The electronic industry chain is a closely linked chain. When the whole industry is shaken, the whole industry will change. Regarding the question of whether the price will rise after the disaster, in addition to looking at the market supply and demand, it is necessary to see if anyone is "playing". If you are not careful, it is easy to become a "group play" of other people's stories.